There are those who will read this blog who are not concerned with such honest self-assessment. This may be one of many blogs they are scanning, perhaps to gain some psychological short-cut to propel them into a higher bonus bracket. Others may plow through these pages, desperately seeking to discern some marketing mind trick with which to further dupe their clients, managers, firms.

There are those who will read this blog who are not concerned with such honest self-assessment. This may be one of many blogs they are scanning, perhaps to gain some psychological short-cut to propel them into a higher bonus bracket. Others may plow through these pages, desperately seeking to discern some marketing mind trick with which to further dupe their clients, managers, firms.

Those are not my target readers. While I am not so self-enamored to believe all who read this blog absolutely must develop their own Gyroscope, I do hope some will invest the time to at least consider how to apply my techniques to improve their circumstances. To improve themselves.

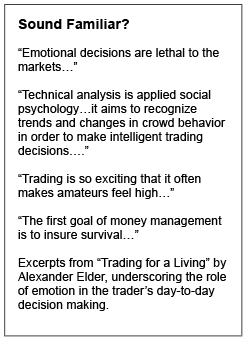

In his book “Trading for a Living” [1], Alexander Elder shares his concept that successful trading is based on the 3 M’s: Mind, Method and Money. The key to winning in the market and within yourself is in your mind, as Elder explains that the proper method involves the development of discipline in order to avoid emotional trading.

In his book “Trading for a Living” [1], Alexander Elder shares his concept that successful trading is based on the 3 M’s: Mind, Method and Money. The key to winning in the market and within yourself is in your mind, as Elder explains that the proper method involves the development of discipline in order to avoid emotional trading.

This is but one aspect of the comprehensive Wall Street Psychologist’s Gyroscope I conceived, and it is a vital element.

Finding good trades is key, based on computerized indicators, charting, and other methods. One’s trading system is created by combining methods into one’s own powerful and unique trading system. Money management is paramount and one must create and maintain rules for limiting risk which always exists, lurking and threatening, risk is inherent and should always be managed; to think otherwise is, again, to be naïve and arrogant.

[1] Elder, Alexander. “Trading for a Living.” John Wiley & Sons. New York, 1993